Employee Checklist

Some personal and employment information is required for each employee in Self Manager that is employed by a Manager with Single Touch Payroll enabled. We have compiled the following checklist for you to review on each of your employee records. If you require any assistance with this, please get in touch with us for support.

Checklist

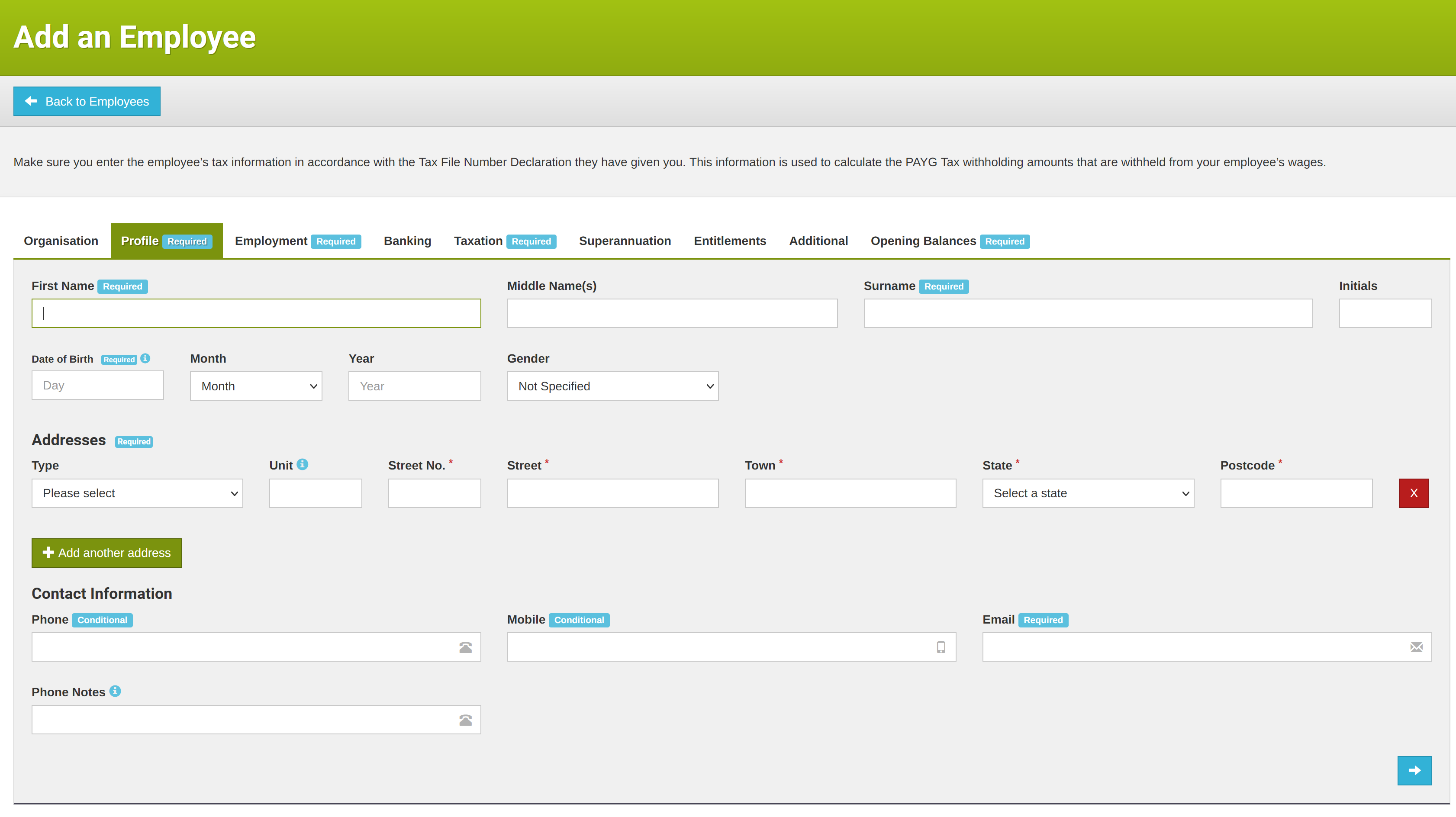

Employees require contact information

All employees must have their contact information populated. The following fields on each employee must be filled in:

- First name

- Surname

- Address (at least one address specified)

- Phone number or mobile number

- Email address

Most of these fields are already required in Self Manager, but it is recommended to review each employee to ensure that their contact information is up-to-date. You can review your employee records by going to the Employees list and clicking on the name of the employee, or alternatively, the green "Edit" button (with a pencil icon) on the right.

All information above can be edited in the Profile tab.

All employees require their date of birth

The ATO requires that all employees have their date of birth provided, as this can have an effect on several aspects of their pay, including how much tax to withhold or how much superannuation they accrue.

As with the fields above, the Date of Birth fields are mandatory when entering a new employee in Self Manager.

These fields are found in the Profile tab.

All employees require a Tax File Number (TFN)

The Tax File Number is the identifying number that allows the ATO to link a particular person to their taxation record. This is a required field in Self Manager, so it should already be populated when entering a new employee in the system.

If an employee has not provided you with a Tax File Number, or is exempted from requiring a Tax File Number, there exists four special Tax File Numbers that you can use in these scenarios. You may use these Tax File Numbers instead if they meet the criteria for that case.

| Tax File Number | Criteria |

|---|---|

| 000000000 | If the employee has not provided a TFN, or fails to provide one within 14 days of starting employment and also fails to provide advice that they are applying for a TFN. |

| 111111111 | If the employee is in the process of applying for a TFN. This is a temporary code, and should be changed to the employee's TFN when they receive one, or after 28 days, to the no TFN code above. |

| 333333333 | If the employee is under 18 years old and claims a general exemption from requiring a TFN as their income is too low (less than $350 per week, $700 per fortnight or less than $1,517 per month). |

| 444444444 | If the employee is the recipient of a social security or service pension or benefit and can claim an exemption from quoting a TFN. |

The Tax File Number field can be edited in the Taxation tab.

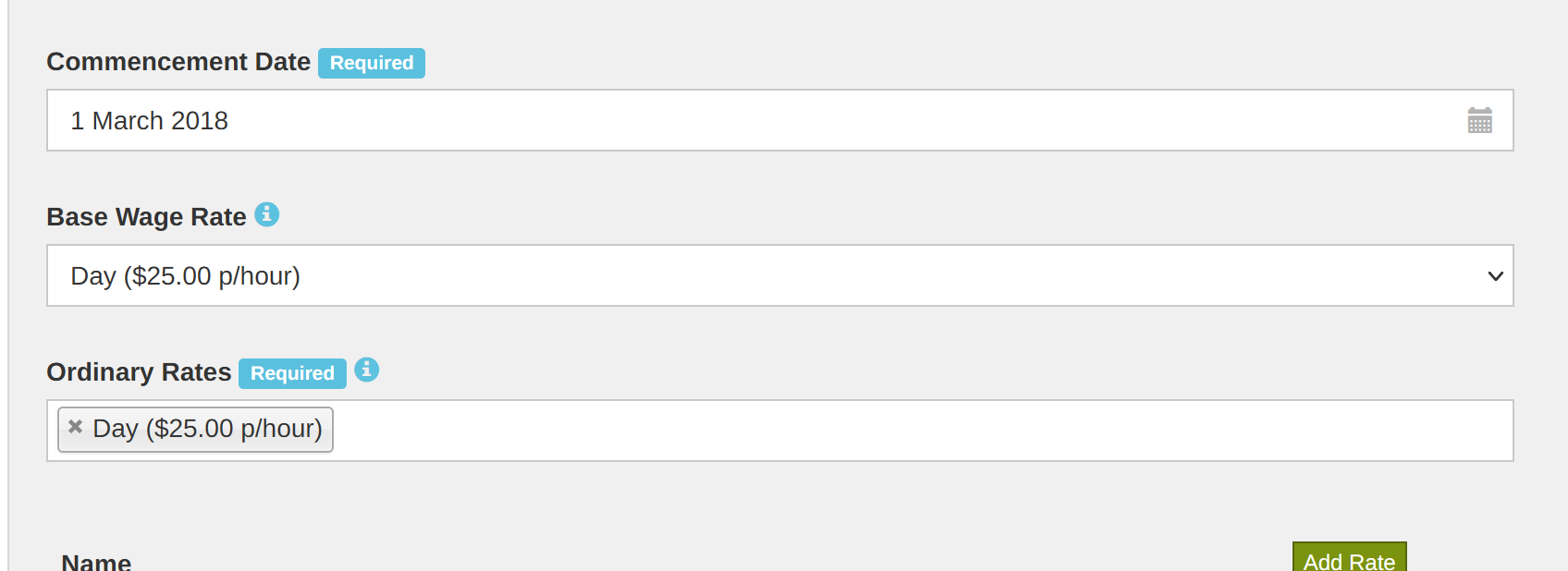

All employees require a correct Base Wage Rate and correct Ordinary Rates

With Single Touch Payroll Phase Two, all income that is not an ordinary rate is considered to be Overtime and will be reported as such.

The Base Wage Rate determines the standard rate to apply for payments such as leave, redundancy and termination payments and payments in lieu of other benefits. It is important that this be set to the correct rate so that the employee is not overpaid or underpaid for these entitlements.

The Ordinary Rates are rates that accrue superannuation or are used for standard hours of work for that employee.

Both of these can be modified in the Employment tab of the Employee form.

Contractors must now be defined as "Labour Hire" or "Voluntary Agreement"

This has changed in Single Touch Payroll Phase Two.

Previously in Self Manager and Single Touch Payroll Phase One, employees who work under a contractual basis were simply stated as Contractor in their Employment Type, found within the Employment tab of the Employee form.

With Single Touch Payroll Phase Two, employees must now either be stated as one of the following Employment Types:

- Labour Hire: If you pay the employee for work or services provided directly to a client and is invoiced to you, and is not under an employment contract directly with you

- Voluntary Agreeement: If an employee is a contractor who has an Australian Business Number (ABN) and has agreed to have tax withheld by you.

Which one to use is entirely up to you and the employee, and should be agreed to before work is undertaken.

For more information on these employment types, please see the following:

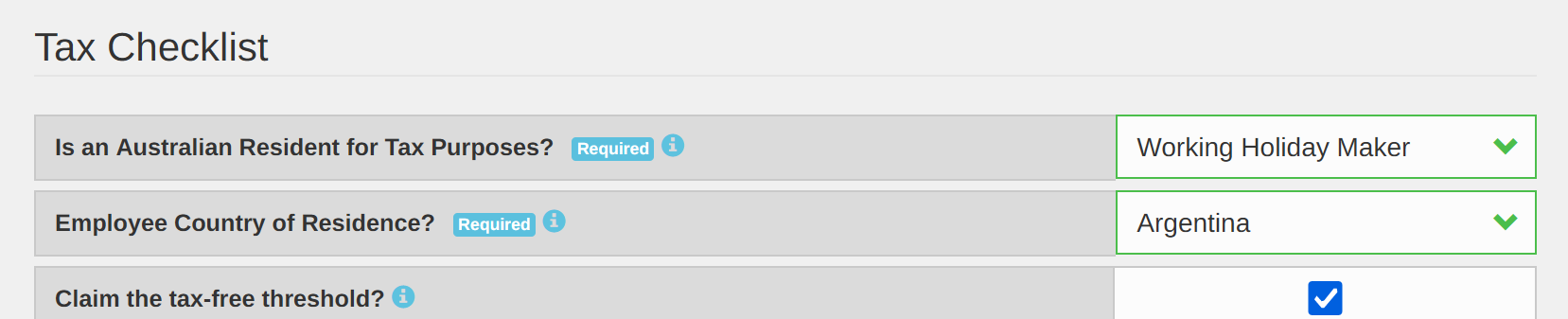

All employee must have their Residency Status specified

In Single Touch Payroll Phase Two, Working Holiday Makers have been introduced, and must have their Country of Residence specified.

In order to ensure that the correct amount of tax is withheld from an employee's pay on each pay cycle, their correct Residency Status must be applied to their record.

This is defined in the Taxation tab of the Employee form, under the Tax Checklist heading, with the name of the field being Is an Australian Resident for Tax Purposes?.

You may choose from one of three options:

- Resident: A citizen or permanent resident of Australia.

- Non-Resident: A person who is working in Australia but is not a citizen or permanent resident.

- Working Holiday Maker: A person who is not a citizen or permanent resident and is working in Australia under a 417 Working Holiday or 462 Work and Holiday (Backpacker) subclass visa.

If Working Holiday Maker is chosen, the employee must have their Country of Residence specified. This must be set to their country of origin, or where they hold a residency in.