Finalising Payroll

At the end of each financial year, you will need to finalise payroll and report the final values for each employees' gross, tax and super amounts to the Australian Tax Office (ATO). This makes the financial year "tax-ready" for the employee and allows them to confidently fill in their tax returns for the financial year.

The Australian Tax Office requires that payroll finalisations must be processed by the 14th July each year, unless the employer applies for a deferral.

Self Manager makes this process less time-consuming by automatically setting up a pay finalisation for each financial year that you have active employees. This pay finalisation allows you to review and submit the final payroll information to enable your employees to complete their tax returns.

Note: For long-term users of Self Manager, please note that this process replaces the old Pay Summaries process, and that Pay Summaries are no longer required to be generated and sent to the employee. You may continue to do so if your employee prefers this format, but please be advised that the ATO no longer accepts these paper versions, therefore any Pay Summary is advisory and unofficial.

Reviewing your finalisation

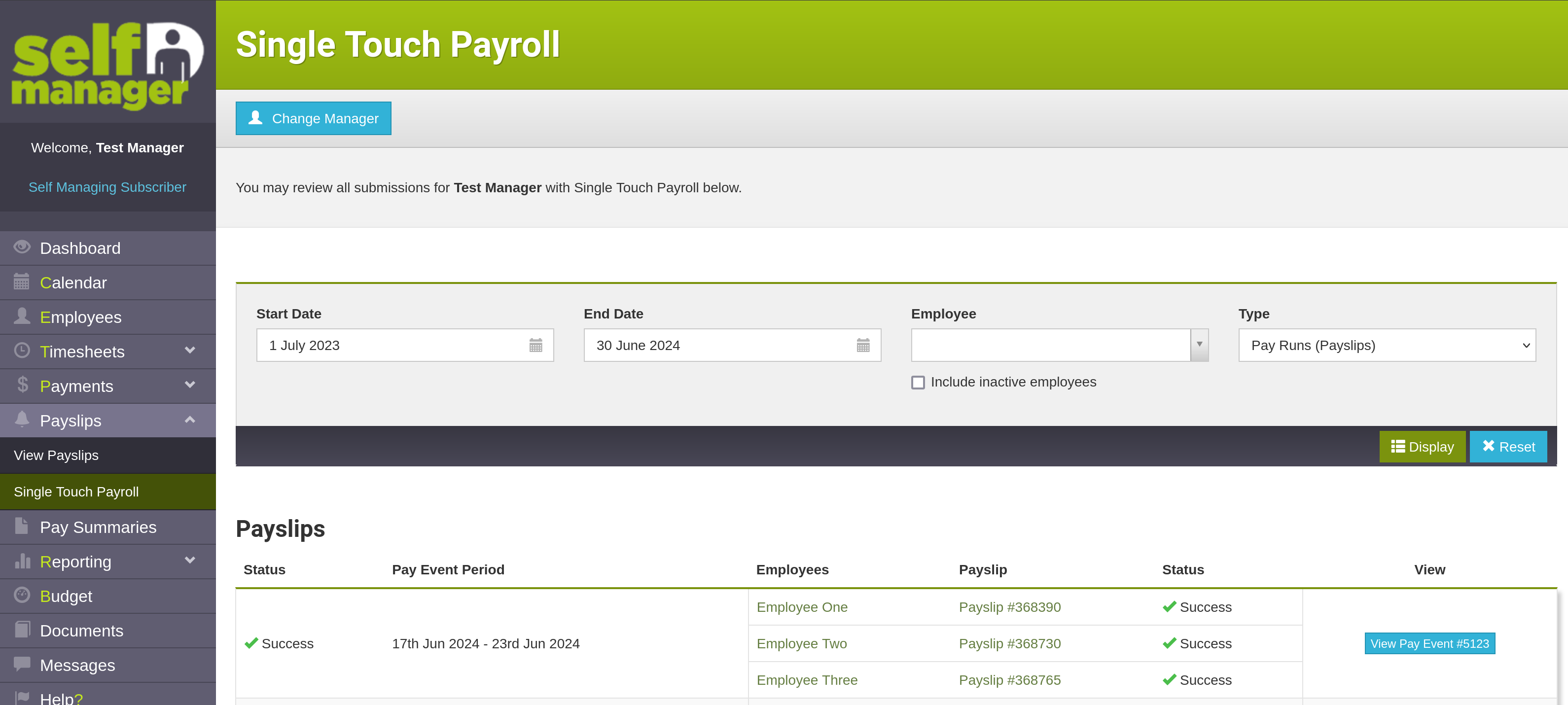

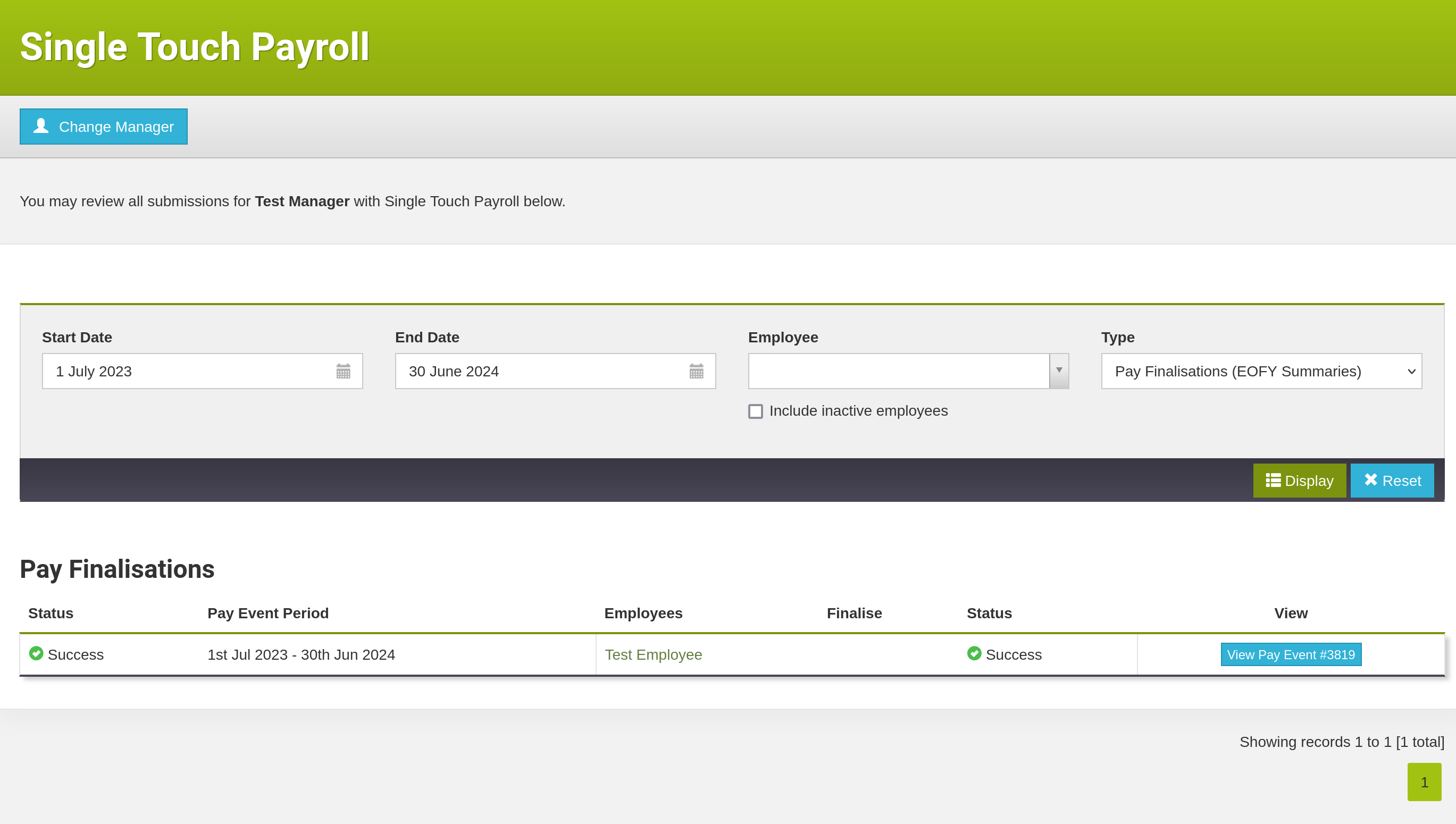

You can review your pay finalisations in the Single Touch Payroll screen in Self Manager. This can be found by clicking the Payslips menu item in the main navigation, and then clicking the Single Touch Payroll item underneath.

If you see the list of Pay Events, similar to the above screenshot, you can switch to viewing pay finalisations by changing the Type dropdown in the fields at the top of the page to Pay Finalisations (EOFY Summaries) then pressing the Display button to switch the page.

Optionally, you can also change the start and end date fields, or select an employee, if you wish to view historical information or limit your search to a particular employee.

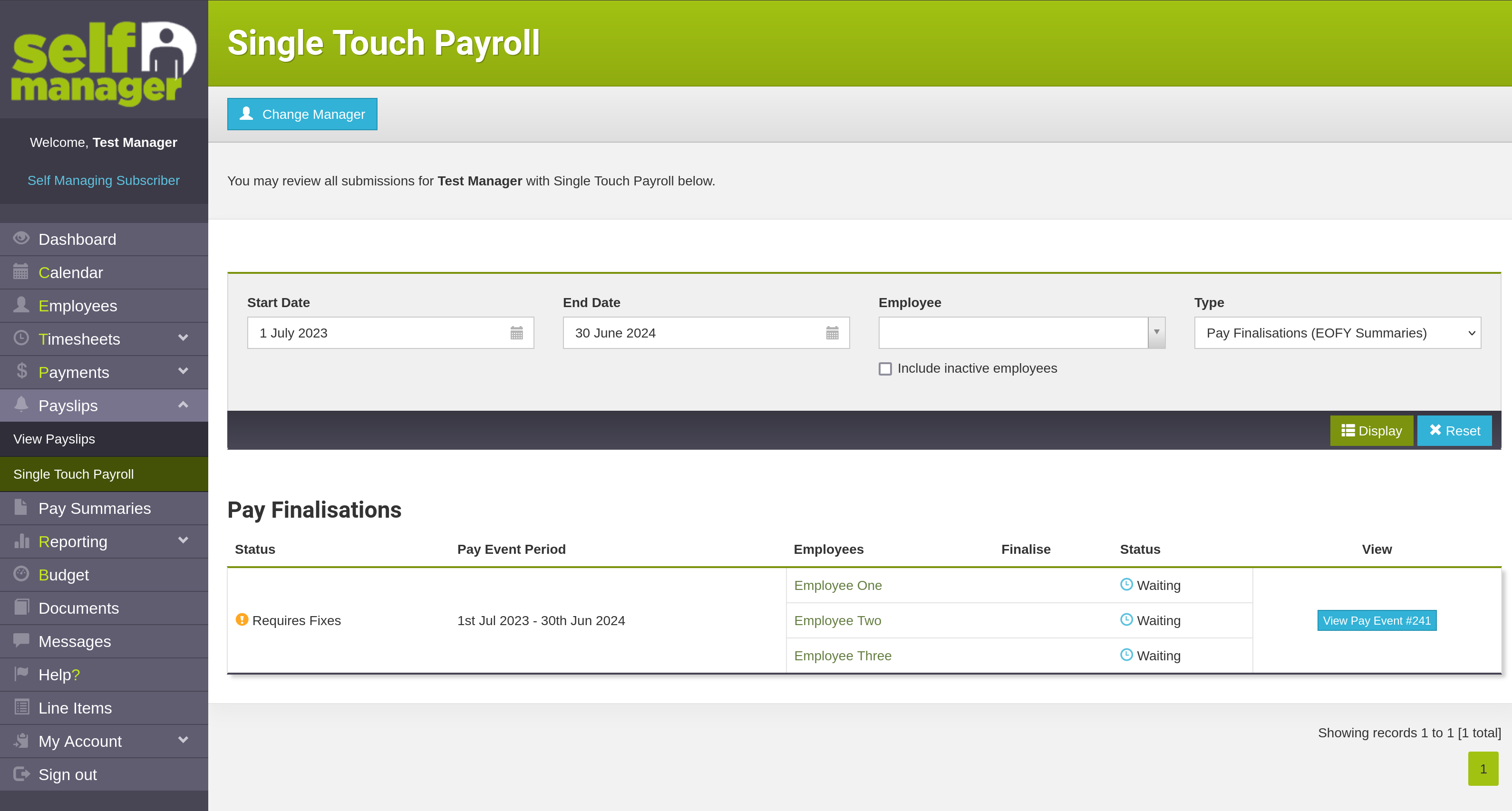

Pay finalisations generally encompass the entire financial year (1st July to the 30th June of the next year), and cover all your employees. This means that you must finalise all your employees. You can review the status of your pay finalisation by pressing the View Pay Event button next to your employees, which will take you to a detail screen for that finalisation.

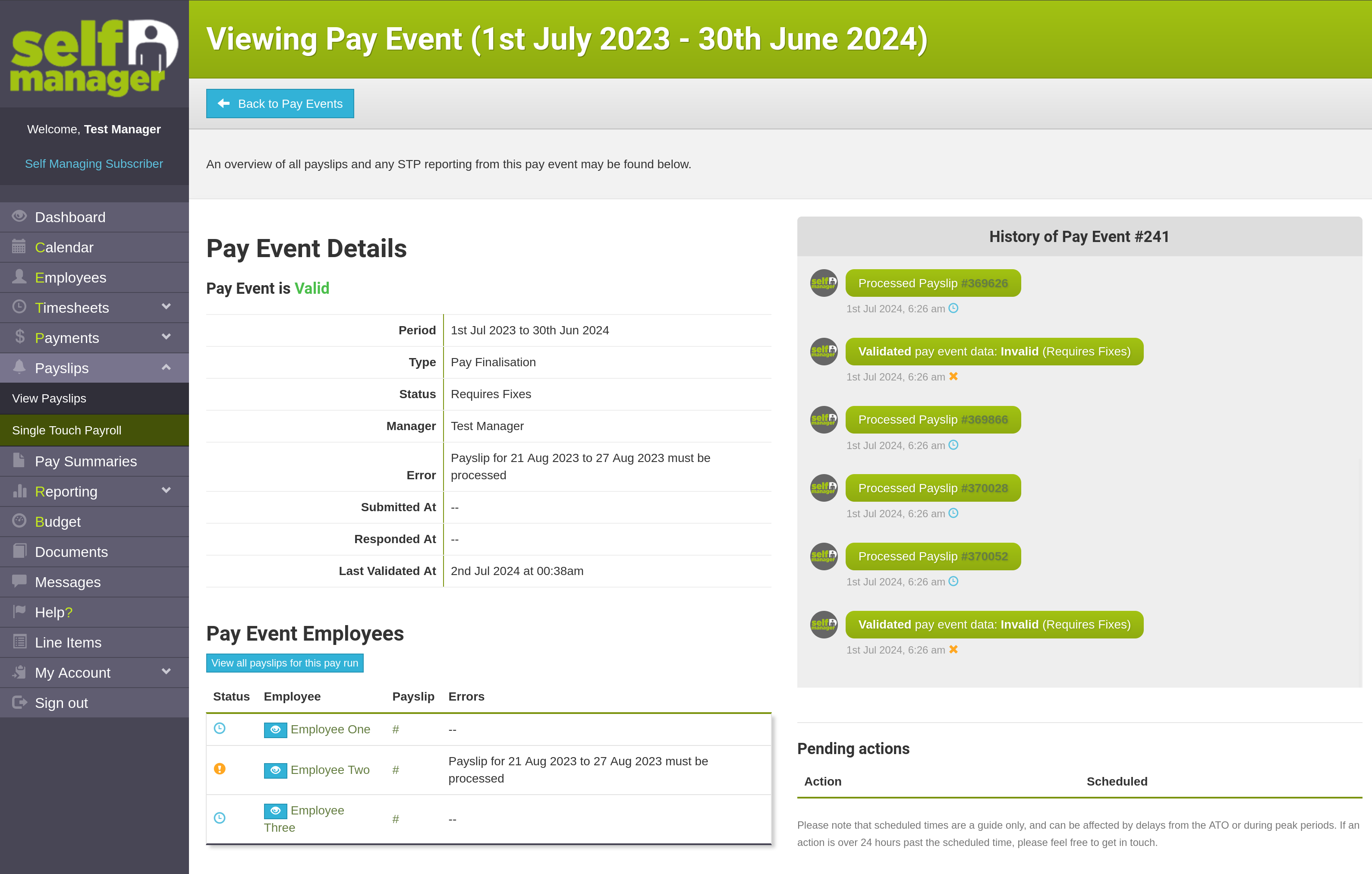

This detail screen indicates the following:

- The type of pay event, and the period it covers - in the case of a finalisation, it will indicate the financial year period that it covers.

- The employees who are covered by this finalisation, and any issues that are preventing finalisation for that employee.

- The actions taken for this finalisation, for example, payslips that have been processed within the financial year, and validation of the data in the pay event.

By clicking the Eye button next to an employee, you can see the exact information that we will send through to the ATO for that employee.

Before processing your finalisation

Before processing your pay finalisation for the financial year, it is important to check all the following information:

- All your employee's contact, tax, super and payroll information must be correct.

- If an employee ceased employment during the financial year, please ensure that the employee has been terminated in Self Manager.

- All payslips, including empty payslips, that were either paid in the financial year or ended within the financial year, must be processed. You may set the payment date for any empty payslips to 30th June of that financial year.

To review the applicable payslips, there is a button in the detail screen for a finalisation - View all payslips for this pay run - located above the Pay Event Employees list. Clicking this button will take you to the Payslips screen and filter the payslips to show all payslips that fall within the financial year, including empty payslips.

Processing your finalisation

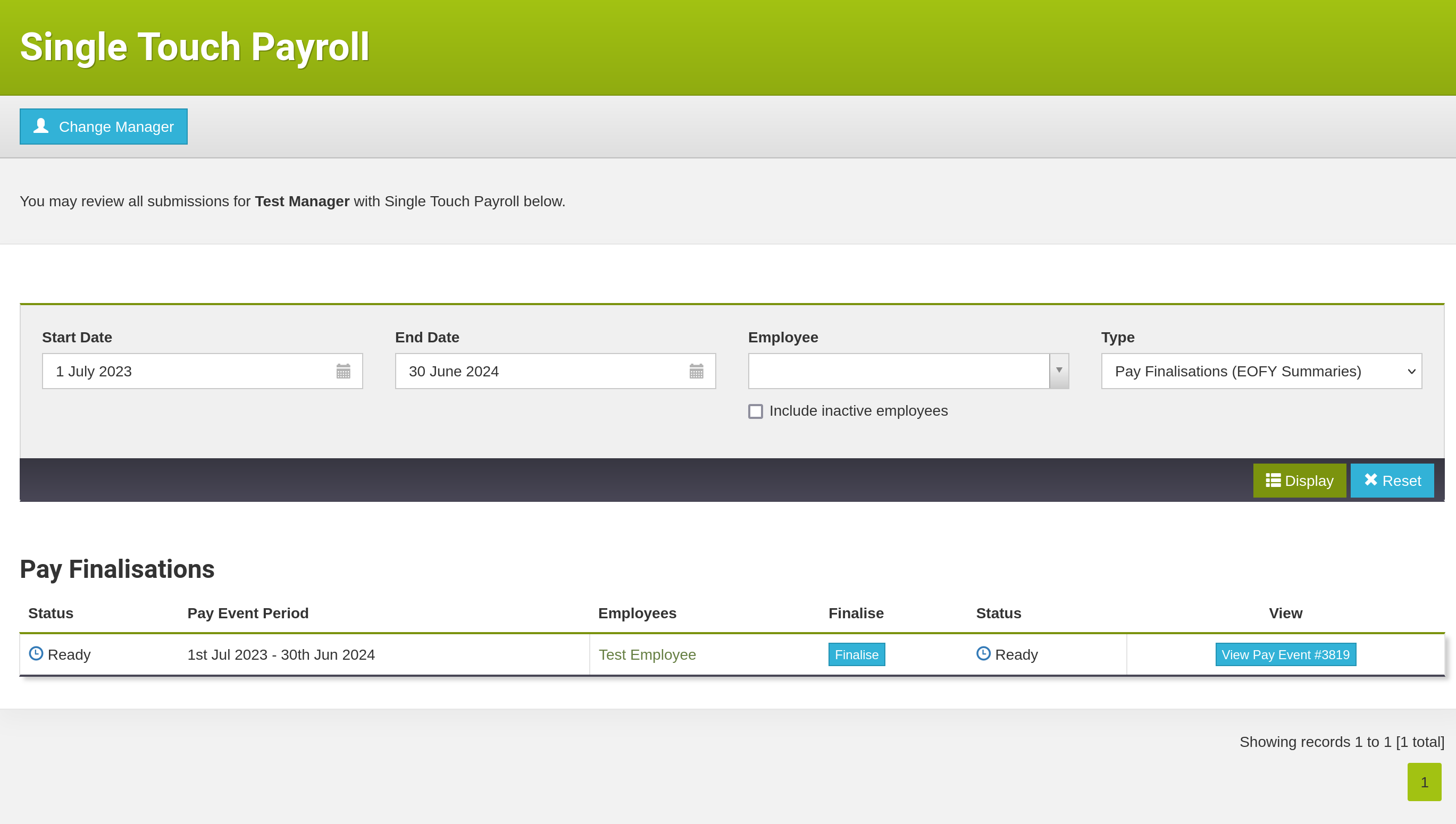

Once the above steps are done, in most cases, your finalisation will be ready. This will be indicated by the finalisation having a status of Ready and the Finalise button being available next to each of your employees in the finalisation.

Clicking on the Finalise button will send off that employee's information to the ATO. Once the ATO has reviewed the data and approved it, the employee's finalisation is complete, and you will see a Success status next to the employee. Once the entire finalisation is done, that same Success status will be applied to the finalisation itself.

If the ATO reviews the data and indicates that there are errors, you will be alerted to this fact.

Important: The ATO can take time to respond to a finalisation, especially around tax time. We expect a response within 30-60 minutes of submission in general, but please allow up to 24 hours for the ATO to respond. If you have not received a response by that point, please get in touch with us.

Troubleshooting

Here are some common scenarios why you may be unable to complete finalisation, and the ways to fix them.

Employee(s) have outstanding payslips

If an employee has a status of Requires fixes and in the details page, it indicates that a payslip has to be processed for that employee, this means that the employee still has an unprocessed payslip for the financial year. This includes empty payslips, the pay periods in which the employee did not work. If you have to process an empty payslip for the employee, you may feel free to set the payment date to the 30th June of that financial year.

I cannot see the Finalise button for my employees

Finalisation may only begin when all payrolls for all employees are completed. Please ensure that any employees who have a status of Requires fixes are resolved.

We're here to help

We understand that tax time can be quite intimidating for some people, especially those with a lot of employees. We are available to provide assistance with getting your finalisations done on time. Please feel free to contact us if you require help.

- Email: info@manageit.com.au

- Phone: 08 9380 0271