Manager Checklist

Some personal and accounting information is required for each manager in Self Manager that has Single Touch Payroll enabled. We have compiled the following checklist for you to review on your manager profile. If you require any assistance with this, please get in touch with us for support.

You must also ensure that all employees have their required information updated as well. See the Employee Checklist for what is required in your employee information.

Checklist

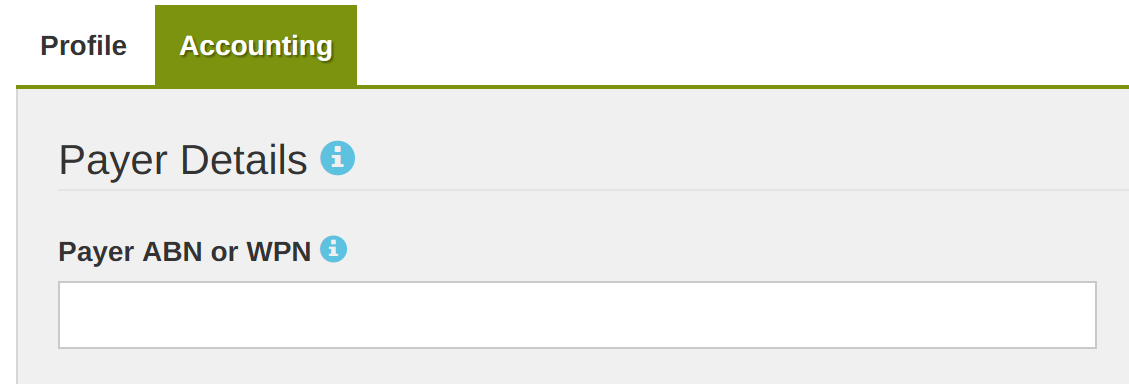

You require a valid ABN or WPN

When reporting in Single Touch Payroll, the Payer - the person paying the wages of the employees - must have an Australian Business Number (ABN) or a Withholding Payer Number (WPN) to identify themselves to the ATO. You may enter this in the Accounting tab on the My Profile page.

From 1st July 2023, all WPN holders must report in Single Touch Payroll, as the previous exemption that affected WPN holders will expire 30th June 2023. Please see the WPN Holders page for more information.

You must have a valid Australian address and phone number

The ATO requires that all payers who report through Single Touch Payroll must provide an address and contact phone number in order to be able to be contacted by the ATO in circumstances where your reporting must be discussed. The contact phone number can either be a landline phone number, or a mobile phone number.

As with the ABN/WPN field above, both your address and phone number can be specified in the My Profile page, within the Profile tab.

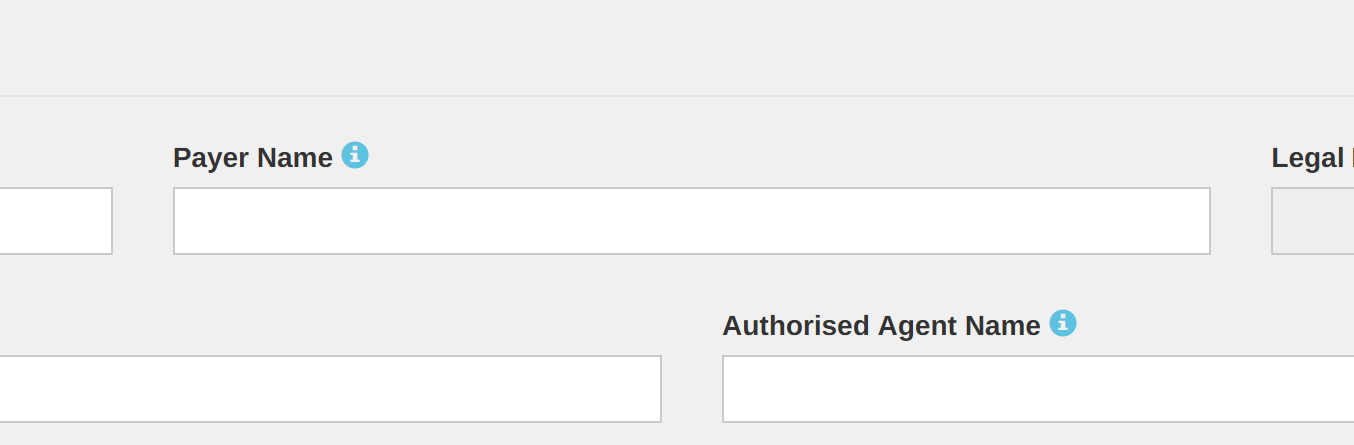

WPN holders must specify a Payer Name

If you hold a Withholding Payer Number (WPN), you must specify your Payer Name which appears on payslips generated by you for your employees. This name is also provided to the ATO in order to fill in your employees' employment details for income statements and tax returns.

You may enter this in My Profile page in the Accounting tab.